To understand why Americans save less than they used to, we should look at what savings are for and what the alternatives to saving are. Put simply: savings are for future expenses. Alternatives to saving would be other ways to pay for future expenses.

We save because we anticipate a mismatch between future expenses and the resources to pay for them. For example:

1. Retirement

2. Big Ticket Items

3. Financial Shocks

4. Our children's education

I’ve dealt with Retirement and Big Ticket Items (in the form of housing and, to a lesser extent, cars). Now let’s look at Financial Shocks, focusing on sudden cut-off of an income stream. Usually we’re talking about a job lost to employer action (being laid off) or disability. If people are less worried about financial shocks, they may save a little bit less than before.

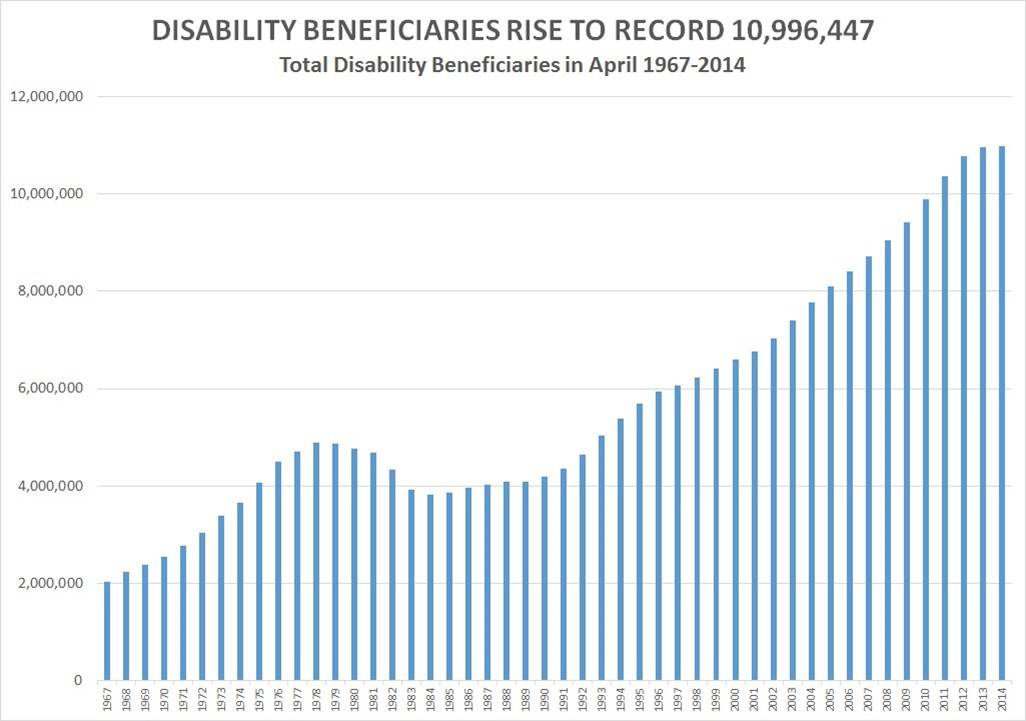

The value or duration of unemployment benefits haven’t changed all that much in the past 50 years, so that’s probably a dead-end as far as a possible reason for declining savings rates. Disability is another matter. Check it out:

Simply put, it’s easier to get Social Security Disability Insurance than it used to be. And benefits are worth more than they used to be. And only a small part of the increase in SSDI recipients can be attributed to aging baby boomers. Note too that SSDI (after a lag time) comes with Medicare. So one big worry that spurs savings – the prospect of disability – is not quite as frightening as it used to be.

There is no single reason why Americans are saving less. Just a lot of middling reasons, of which the availability and value of SSDI is one.