Ah, those were the days: the 1950s, when the top marginal tax rate was 91% and the economy was booming. See, soaking the rich works!

Not necessarily. Consider the following:

In 1955, the only people paying 91 percent were those making over $3,425,766 when adjusted for inflation. They represented the top 0.01 percent of income earners at the time (about 4700 households).

Although the “official” tax rate was 91 percent for this group, their effective tax rate – what they ended up paying, on average - was actually 45 percent.

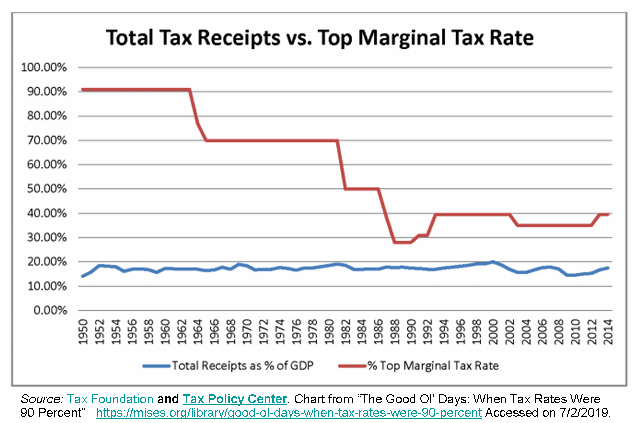

As a percentage of GDP, federal tax revenues were no higher in the 1950s than they are now. For instance, tax receipts from personal income taxes have consistently been between 7 and 9 percent over the past 70 years.

The reduction in the top marginal income tax rates since the 1950s has had little association with saving, investment, or productivity growth.

The top tax rate reductions do appear to be associated with the increasing share of income earned by those at the top of the income distribution.

However, there is a lot of turnover at the top. By the age of 60, 70% of US earners will have spent one or more years in the top 20% of the income distribution and 11% of earners will have made it to the top 1%. So, a lot of Americans are reaping the spoils at the top, at least for a while.

The percentage of taxes paid by the top 20 percent of income earners has steadily gone up since 1980:

In 1980, the top 20 percent of earners paid about 55 percent of all income taxes. Today, it’s just shy of 70 percent.

The same goes for the top 1 percent, which went from paying about 15 percent of all income taxes in 1980 to just shy of 30 percent today.

So what did the very high marginal tax rates accomplish in the 1950s? The very rich in any given year were slightly less rich than they are now. However, Uncle Sam didn’t collect more taxes overall and the top tax rates appeared to have little influence on productivity or economic growth.

Chart!

References:

Hirschl TA, Rank MR (2015) “The Life Course Dynamics of Affluence.” PLOS ONE 10(1): e0116370. https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0116370

Hungerford, Thomas L. “Taxes and the Economy: An Economic Analysis of the Top Tax Rates Since 1945” Congressional Research Service. September 14, 2012

Syrios, Andrew “The Good Ol' Days: When Tax Rates Were 90 Percent” 11/24/2015 https://mises.org/library/good-ol-days-when-tax-rates-were-90-percent